The purpose of this procedure is to define the requirement for the management of Petty Cash in offices and any type of projects as applicable. This procedure describes the process for the establishment and changes to the Petty cash float and the processing of claims and reimbursement of cash.

This procedure applies to all offices and projects of the company.

References, Definitions and Abbreviations

Petty Cash Voucher

Petty Cash Physical Cash Verification

Petty Cash Reimbursement Control Sheet

Claimant: Any staff member of making a claim for petty cash.

Custodian: Member of the respective finance team responsible for payment of petty cash.

Float Amount: Advance held to pay petty cash claims.

Head Office: The respective Head Offices of company

PIC Finance: The person with the highest management responsibility for financial matters in a particular office or project involved in smooth cash flow.

Responsibilities

The following personnel have responsibilities mentioned in this procedure:

– Corporate Heads of Finance (Chief Financial Officer, Finance Director)

– PIC Finance

– All staff involved

– Petty Cash Custodian

– Supervising Accountant

Petty Cash Handling Procedure

Offices and projects of company are required to keep and maintain a system of petty cash which is the responsibility of the Finance Department of that particular office or project.

Cash Expenditure (Petty Cash)

a) A petty cash float will be maintained by the applicable Finance department. The amount of the cash float will be determined by the PIC Finance for the respective office or project.

b) This initial amount and possible future amendments will be subject to the approval of the Corporate Heads of Finance or respective Project Director/ Manager.

c) The cash float shall be kept by a responsible staff member appointed by the PIC of Finance and adequate security measures shall be taken to prevent any loss. Consideration shall be given to taking out an insurance policy to cover any losses from petty cash.

d) The following types of expenditure will be processed through the petty cash float:

i. Sundry purchases which are not large enough to justify a purchase order or where a credit account is not available with the supplier.

ii. Employee expenses, reimbursement of amounts paid direct by company employees.

e) Reimbursement of amounts connected with an employee’s contract of employment shall be made directly by the employing company and not through petty cash.

Petty Cash Claim

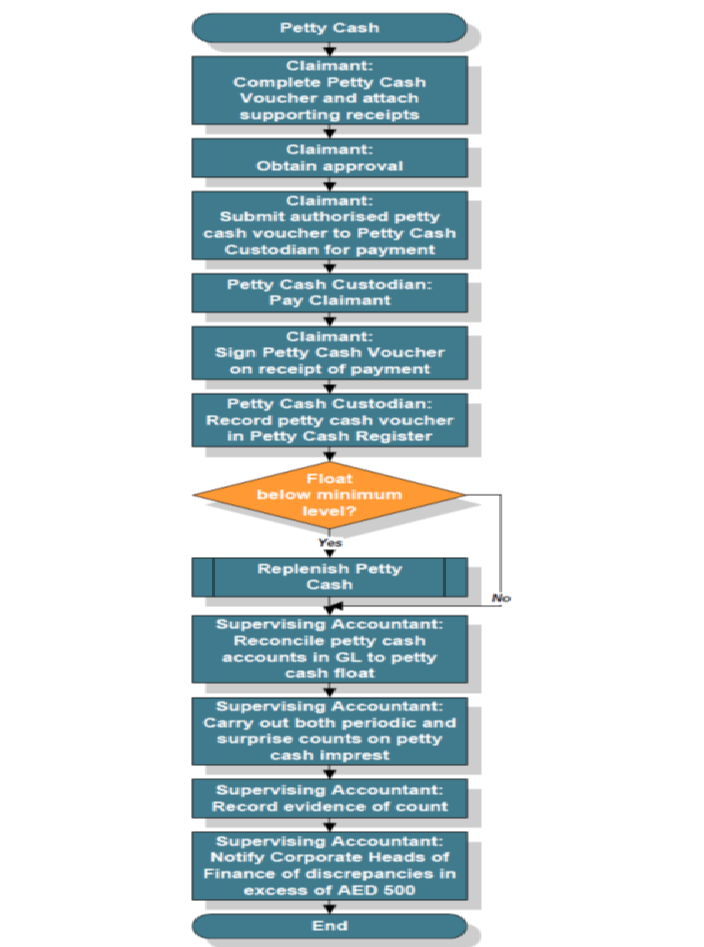

a) In order to be reimbursed by petty cash the claimant shall complete Petty Cash Voucher and shall attach the supporting receipts.

b) The claimant should obtain approval for the petty cash voucher in accordance with the appropriate Delegated Authority Matrix or as determined by the PIC Finance in that claimants respective office or Project.

c) The claimant shall submit authorized petty cash voucher to petty cash custodian for payment. d) If acceptable the petty cash custodian shall pay the claim and the recipient shall sign the petty cash voucher as evidence of being in receipt of the cash.

e) When the voucher has been reimbursed the voucher and the supporting documents / receipts shall be stamped as “PAID” by the petty cash custodian to prevent re submission.

f) All petty cash vouchers should be given a numeric sequence number by the petty cash custodian and be recorded in the Petty Cash Register – Petty Cash Reimbursement Control Sheet.

Petty Cash Reimbursement

a) The petty cash float will be reimbursed when the float reaches a preset minimum level as determined by the PIC Finance.

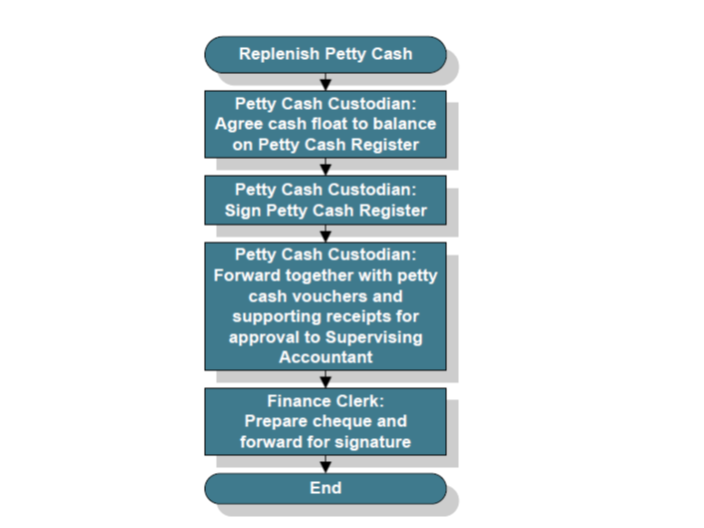

b) The petty cash custodian shall finalize the petty cash register and verify that the physical remaining cash float agrees to the balance on the Petty Cash Register.

c) The petty cash custodian shall sign the completed petty cash register and forward together with the petty cash vouchers and supporting documentation to the Supervising Accountant for approval.

d) A cheque may then be prepared to reimburse the petty cash floa The value of the cheque will be as per the “This Claim” amount shown on the petty cash register and will bring the float back to its cash float amount.

e) The cheque (along with the payment voucher and supporting documents) will be forwarded for signature in accordance with the appropriate bank mandate.

f) At the end of each accounting period the Supervising Accountant must ensure that the petty cash accounts in the General Ledger reconcile to the cash floats held.

g) The Supervising Accountant shall carry out both periodic and surprise counts on all petty cash float to ensure that:

i. the actual cash balance agrees to the authorized cash float amount;

ii. that no unauthorized advances have been made.

h) Evidence of the count shall be recorded on Petty Cash Physical Cash Verification form, and any discrepancy in excess of USD 500 shall be notified to the Corporate Heads of Finance.

i) The accounting entry for petty cash expenditure is:

Dr: Expenses account

Cr: Petty Cash Account

j) The accounting entry for petty cash reimbursement is:

Dr: Petty Cash Account

Cr: Bank

k) The petty cash documentation shall be sequentially filed for record and audit purposes.

Related Records

Cash Voucher

Petty Cash Reimbursement Control Sheet – register

Petty Cash Physical Cash Verification

General Ledger

Flow diagram Petty Cash & Replenish Petty Cash